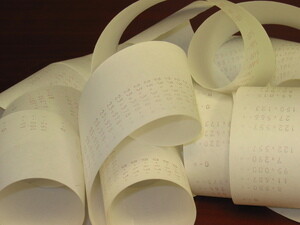

We now live in a digital world with computers, the Internet, and the advancement of almost all electronic devices we use daily. Still, some small business owners encumber themselves with several paper receipts due to the fear that their auditor might disregard electronic records. As a matter of fact, digital records for small businesses have been allowed since 1997. Below are ways on digitizing your paper records:

We now live in a digital world with computers, the Internet, and the advancement of almost all electronic devices we use daily. Still, some small business owners encumber themselves with several paper receipts due to the fear that their auditor might disregard electronic records. As a matter of fact, digital records for small businesses have been allowed since 1997. Below are ways on digitizing your paper records:

1. Gather the information needed by the Internal Revenue Service. Accordingly, valid electronic receipts should contain the name, address, transaction date, and amount paid.

2. Update the database regularly. It’s advisable to input into the system the data needed as soon as each transaction finishes.

3. Backup your data regularly. To be on the safer side, have an external or cloud backup of all the receipts entered into the system.

To gather more knowledge on tax receipt digitization, you can visit this site here.